Vietnam has the third largest proven oil reserves in the Asia Pacific region - but much of its existing offshore production is from declining shallow water fields. So the country’s first deepwater discovery, made in October, is a potentially exciting development. Could deepwater E&P activity in Vietnam be set to take off, or will weak oil prices and disputes over territorial waters prove problematic?

Shallow Beginnings

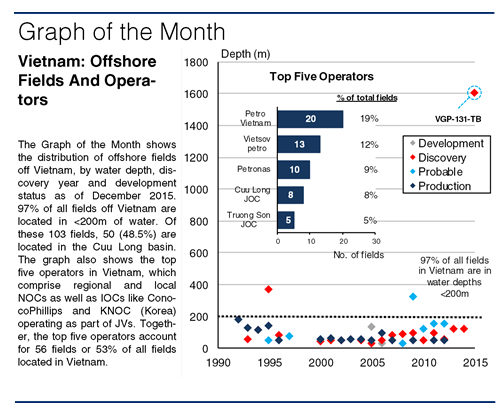

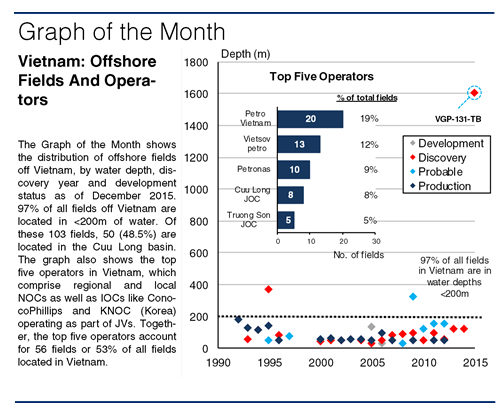

Most of Vietnam’s 0.28m bpd of offshore oil and 0.99bn cfd of offshore gas production is derived from fields in the Nam Con Son and Cuu Long basins, all of which are in less than 200m of water. The Cuu Long basin is perhaps the most successful area off Vietnam as it is home to many large fields, including Bach Ho, Su Tu Vang and Rang Dong. The dominance of shallow fields has skewed development towards fixed platforms. 88% of all active Vietnamese fields are exploited as such. Of these fields, the Bach Ho field accounts for 34 fixed structures or 37% of the total found on active fields.

Operators in Vietnam mainly consist of local and regional NOCs as well as IOCs (most commonly via joint operating companies in partnership with Petrovietnam). While significant market reforms have increased foreign investment in Vietnam’s offshore sector, further improvements to its transaction and tax systems could quicken the pace of foreign participation in the future.

Operators in Vietnam mainly consist of local and regional NOCs as well as IOCs (most commonly via joint operating companies in partnership with Petrovietnam). While significant market reforms have increased foreign investment in Vietnam’s offshore sector, further improvements to its transaction and tax systems could quicken the pace of foreign participation in the future.

Wading Into Deeper Waters

No significant shallow discoveries have been made recently, meaning that there is little to offset Vietnam’s depleting shallow water reserves. This highlights the need to break into deepwater frontiers, which could hold substantial levels of undiscovered hydrocarbons. The VGP-131-TB well, Vietnam’s first discovery in water depths >500m, was drilled in October 2015 by the Vietgazprom JOC, at depths of 1,600m in the Saigon basin. The ultra-deep find could provide momentum for Vietnam’s push into deepwater exploration. However, unlike China, which is able to independently bring deepwater fields like the Lingshui 17-2 online, Vietnam could still need to rely on foreign cooperation to jointly develop such finds in the short term.

Shaky Prospects

Vietnam’s hydrocarbon resources mainly lie in the South China Sea, with the most recent discovery at the southern end. The sea is an area of multiple disputed territorial claims by many countries, including China. This could impede any deep developments, if international partners were to view overlapping sovereignty claims to be an excessive business risk. Perhaps more importantly though, the post-downturn attitude of IOCs is one of cost-consciousness given lacklustre economic conditions. This could skew near-term interest towards safer EOR projects instead of unproven deeper water development in the South China Sea.

Since Vietnam’s historical track record is in shallow waters, even if further deepwater discoveries are forthcoming, then the chance of rapid deepwater developments in the South China Sea is probably going to take time. It is likely to need outside expertise, and the current energy markets may well not be conducive to this. That said, the discovery of Vietnam’s first deepwater field marks a new chapter in the country’s oil and gas story.

Shallow Beginnings

Most of Vietnam’s 0.28m bpd of offshore oil and 0.99bn cfd of offshore gas production is derived from fields in the Nam Con Son and Cuu Long basins, all of which are in less than 200m of water. The Cuu Long basin is perhaps the most successful area off Vietnam as it is home to many large fields, including Bach Ho, Su Tu Vang and Rang Dong. The dominance of shallow fields has skewed development towards fixed platforms. 88% of all active Vietnamese fields are exploited as such. Of these fields, the Bach Ho field accounts for 34 fixed structures or 37% of the total found on active fields.

Wading Into Deeper Waters

No significant shallow discoveries have been made recently, meaning that there is little to offset Vietnam’s depleting shallow water reserves. This highlights the need to break into deepwater frontiers, which could hold substantial levels of undiscovered hydrocarbons. The VGP-131-TB well, Vietnam’s first discovery in water depths >500m, was drilled in October 2015 by the Vietgazprom JOC, at depths of 1,600m in the Saigon basin. The ultra-deep find could provide momentum for Vietnam’s push into deepwater exploration. However, unlike China, which is able to independently bring deepwater fields like the Lingshui 17-2 online, Vietnam could still need to rely on foreign cooperation to jointly develop such finds in the short term.

Shaky Prospects

Vietnam’s hydrocarbon resources mainly lie in the South China Sea, with the most recent discovery at the southern end. The sea is an area of multiple disputed territorial claims by many countries, including China. This could impede any deep developments, if international partners were to view overlapping sovereignty claims to be an excessive business risk. Perhaps more importantly though, the post-downturn attitude of IOCs is one of cost-consciousness given lacklustre economic conditions. This could skew near-term interest towards safer EOR projects instead of unproven deeper water development in the South China Sea.

Since Vietnam’s historical track record is in shallow waters, even if further deepwater discoveries are forthcoming, then the chance of rapid deepwater developments in the South China Sea is probably going to take time. It is likely to need outside expertise, and the current energy markets may well not be conducive to this. That said, the discovery of Vietnam’s first deepwater field marks a new chapter in the country’s oil and gas story.

Source: Clarksons

Relate Threads